\Paylithic> intelligent arrears management

The Automated Debt Collection Agent by Paylithic streamlines your entire process, saving significant time by automating key tasks and minimizing manual intervention. Paylithics system automatically monitors overdue accounts, sends personalized reminder emails, and manages escalations. Crucially, the platform includes a sophisticated AI learning dashboard and a recommendation engine for process improvements. Collection workflows are automated with time-based triggers and condition-based actions. Moreover, Paylithics AI-powered email drafting can drastically reduce the time spent on correspondence.

of property managers find it challenging to handle collection workload

Many agents struggle with time-consuming manual and repetitive tasks. This inefficiency impacts overall productivity and the ability to focus on more complex cases.

Paylithic Reduces Manual Operations By 90%

Agents often have extensive portfolios of accounts to manage, requiring strong organizational skills to prioritize and follow up on arrears effectively.

Arrears Monitoring Life Cycle In A Single Platform

Many agencies still rely on manual, time-consuming processes for tracking payments, sending reminders, and generating reports, which are prone to human error and reduce efficiency.

Integrated Monitoring, Reporting & Communication Platform

A lack of robust CRM tools, automation, and data analytics capabilities, hinder an agent's ability to track outstanding balances, prioritize efforts, and communicate effectively.

Built In Risk Analysis

The Paylithic edge.

Automation that works for you.

Eliminate Data Entry 01

AI Strategy & Prioritization 02

Instant Multi-Channel Outreach 03

Real-Time Reporting & Export 04

The paylithic daily workflow. Automation that works for you.

Streamline your day. Paylithic helps managing agents to solve all their collections challenges by centralizing and automating processes

This workflow ensures your collection team maximizes efficiency and focuses only on **high-value, escalated actions**, letting the AI Debt Agent handle the routine follow-up. Replace repetitive, time-consuming tasks with four simple, self-optimizing steps.

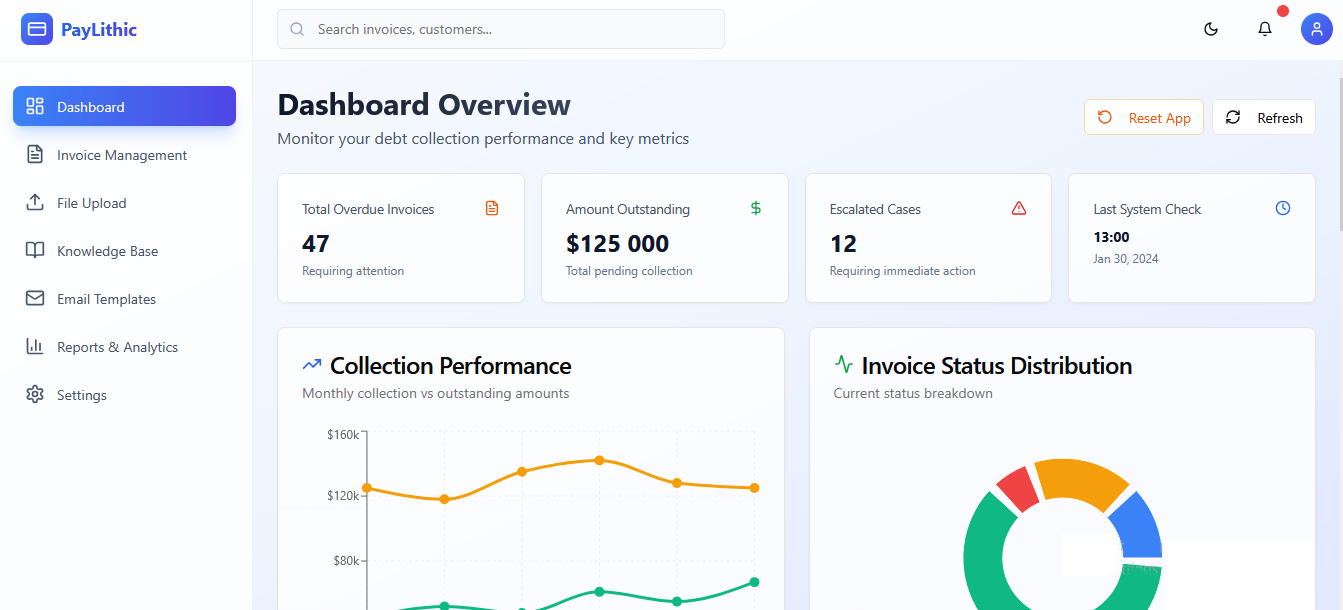

Review Overnight System Updates

Upon logging in, the user immediately lands on the Dashboard to review a concise summary of the system's automated activity. This includes overnight payment updates, new overdue accounts flagged, and a status check confirming the AI Debt Agent performed all scheduled tasks and system integrations are running smoothly.

Approve or Modify Draft Communications

The user reviews the AI-generated drafts for personalized reminder emails (e.g., Friendly Reminder or Final Notice). The AI's proposed communication is presented for quick approval, allowing the user to send communications in bulk with a single click, or make quick, manual customizations to the tone or content before scheduling or sending.

Handle Manual Escalations

The user prioritizes cases that the automation rules have deemed too complex or sensitive for AI handling. This involves reviewing cases that require direct human intervention, such as complex payment plan negotiations, high-value debt, or specific customer disputes. This step ensures that human expertise is applied where it generates the highest ROI.

Update and Document Responses

The user quickly processes any incoming customer responses or communication threads flagged by the system. This includes updating invoice/account statuses, logging customer conversations in the communication timeline, and adding internal notes to ensure all team members have a clear and accurate record of the customer's interaction and current status.

Paylithic product overview. The only solution for arrears collection.

Become a thought leader: Free Resources

Ebook: AI Ethics in Debt Collection

A deep dive into building fair, unbiased, and regulatory-compliant AI strategies for financial recovery.

Download Now →Case study: Paylithic for Property Managers

Paylithic incorporates advanced machine learning tactics to accurately predict payment propensity and automatically optimize the timing of outreach, a crucial functionality detailed in this case study for property managers.

Download Now →Training: Improving your efficiency

At Paylithic, we are deeply committed to ensuring our users are empowered and proficient in utilizing our platform to its fullest potential. Recognizing that the payments landscape and our services are constantly evolving, we view user education as an ongoing, essential partnership.

Read the Story →Simple, Transparent . Pay only for the units you need.

All communication, AI processing, and notification costs are included—no hidden fees.

Standard Tier

For small teams and growing portfolios

ZAR TBA

per unit

- Up to **10 Clients**

- Full AI Strategy & Automation

- **Included:** Email & SMS Notifications

- **Included:** AI Communication Costs

Growth Tier

For high-volume operations and agencies

ZAR TBA

per unit

- **11+ Clients** (Volume Discount)

- Full AI Strategy & Automation

- **Included:** Email & SMS Notifications

- **Included:** AI Communication Costs

*"A unit" refers to a client added to the system, which is defined as a complex. For example, if you have 10 complexes on the system, you have 10 units on the system. Pricing is billed monthly based on the total number of units.

Ready to Transform Your Workflow?

Schedule Your Personalized Demo

Let us show you how Paylithic can transform your debt collection process. Select "Schedule Your Free Demo" fill out the form and we'll schedule a demo tailored to your specific needs.